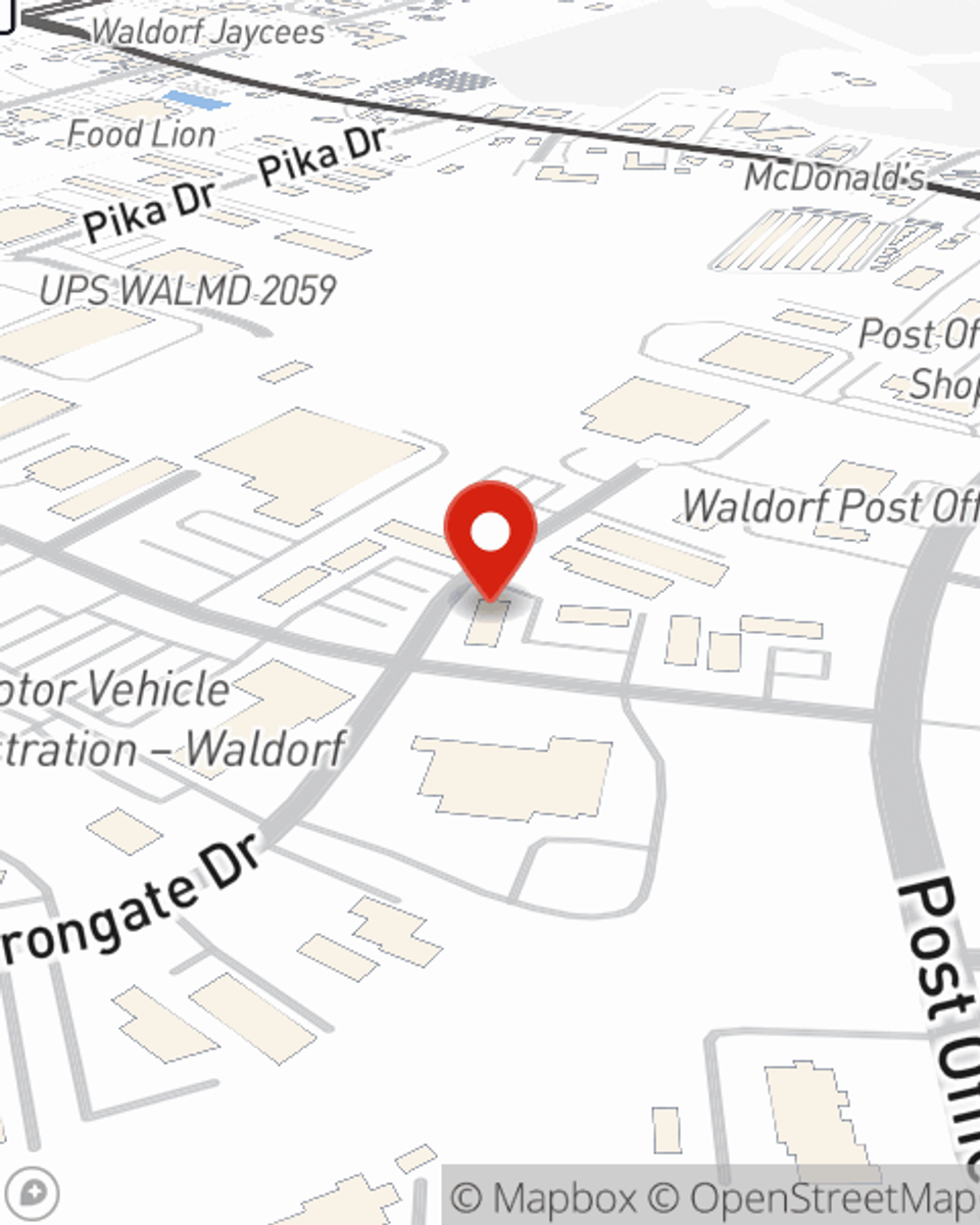

Renters Insurance in and around Waldorf

Your renters insurance search is over, Waldorf

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Waldorf

- White Plains

- Brandywine

- La Plata

- Mechanicsville

- Crofton

- Odenton

- Bryantown

- Bryans Road

- Indian Head

- Hughesville

- Upper Marlboro

- Accokeek

- Fort Washington

- Bowie

- Gambrills

- Pomfret

Insure What You Own While You Lease A Home

Your personal items and belongings have both sentimental and monetary value. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your entertainment center to your lamp. Overwhelmed by the many options? We have answers! Woody Hoyle is here to help you consider your liabilities and help select the right policy today.

Your renters insurance search is over, Waldorf

Renting a home? Insure what you own.

Renters Insurance You Can Count On

Renting is the smart choice for lots of people in Waldorf. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover water damage to walls and floors or smoke damage to the walls, what about the things you own? Finding the right coverage helps your Waldorf rental be a sweet place to be. State Farm has coverage options to align with your specific needs. Thankfully you won’t have to figure that out alone. With personal attention and reliable customer service, Agent Woody Hoyle can walk you through every step to help you build a policy that safeguards the rental you call home and everything you’ve invested in.

There's no better time than the present! Contact Woody Hoyle's office today to discuss your coverage options.

Have More Questions About Renters Insurance?

Call Woody at (301) 645-2221 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Woody Hoyle

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.